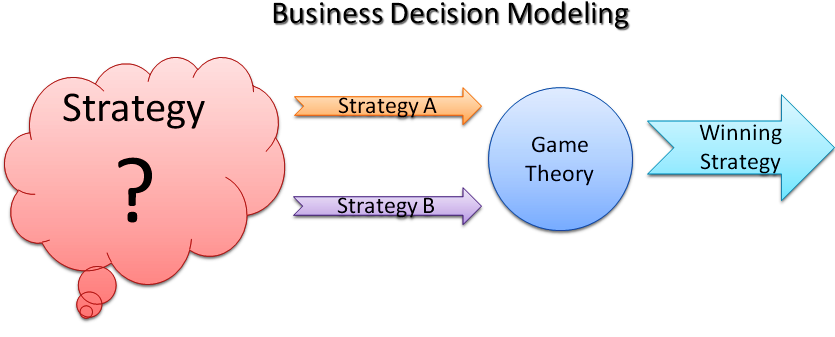

What do you do when you can’t quite figure out which

of two strategies is best for your new business idea?

You simulate. Experts in

economic modeling and business decision modeling recommend that you simulate your strategies before actually

adopting them through game theory.

What is Game

Theory?

No, game theory has

nothing to do with video games or games you play with friends at the club house!

With game theory,

businesses have a tool for making optimized guesses with respect to winning

strategies for their products, services, or processes.

[Related Article: Understanding Market Saturation - Why You Should Never Hesitate]

[Related Article: Understanding Market Saturation - Why You Should Never Hesitate]

How Do Business

Games Work?

In a simple business

game, you have two prospects, A and B. Consider the example below:

In this example, a

business owner wants to decide between two prospects; either opening a new

office (A) or expanding the current office (B) with the goal of generating the

highest sales by the end of the year.

Case

Study: Figuring Out Sales

To demonstrate game

theory, we’re going to use the scenario described above as a case study. To move

forward, we have to figure out how to arrive at a simple equation for sales. Don’t

panic – it’s elementary:

Visibility

As shown above, we first

describe your business’ visibility as the portion of the

local population that is within your catchment factor. Catchment factor

figures tend to be higher for products and services that are required daily or

very frequently, as opposed to luxury or specialty products.

A reasonable catchment

factor for a produce store can be 20% (adjusting for competition) while that

for a luxury makeup store can be something like 3%.

So let’s say you run a

produce store with a catchment factor of 20% in an area with a population of

10,000 people. Your visibility is 10000 x 20% = 2000 people. This means the

maximum exposure for your business in that area is around 2,000 people.

Demand

Once you know your

visibility, the next step is to figure out demand. What portion of your visible

population is confident enough to buy your products or use your services?

For the purpose of this

case study, let’s keep the confidence factor at 20% (for a very credible and well-advertised

business). This gives us a demand of 2000 x 20% = 400 people. This means you

can expect to have about 400 regular customers year-in, year-out. This is your estimated fixed demand.

Daily Demand

Now you know your

estimated fixed demand, the next question is: what portion of your fixed demand

comes to your store daily? This is useful for simulation purposes.

For this case study,

which involves a produce company, it is reasonable that up to a quarter (25%)

of the fixed demand will come to the store each day due to highly perishable

goods. This is the daily factor. Daily demand in this case is therefore 400 x 25%

= 100 people. This means 100 people visit the produce store each day.

Daily Sales

Figuring out the daily

sales is easy at this point because every store owner knows the average

quantity of items bought (per customer) per day and the average cost of items

in the store. Your POS application and automated sales reports can probably

tell you that.

Let’s say for this case

study, the produce store sells an average of 5 items per customer per day, with

an average cost of $10 for items in the store. Daily sales is simply 100 x 5 x

10 = $5,000 (per day).

Total Sales

This is simply the

product of daily sales and the number of days we are considering. For a 30-day

period, total sales in this case can be projected at 5000 x 30 = $150,000.

Simulation:

Building Variables and Weighing the Prospects

Now that we have arrived

at a convenient way of calculating sales, we then move on to the important task

of evaluating two prospects (A and B) to see which generates higher sales over

time.

To do this, we need to

build models for each of the prospects.

Modeling Prospect A: Opening a New Office

As shown above, we

select the daily sales for the new office to vary between 20% and 80% of the

current office sales because the current office is more established, and it has

more dedicated customers.

Modeling Prospect B: Expanding the Current Office +

Advertising

For

the second strategy (a mix of office expansion and advertising), we reasonably fix

the expanded office sales at between 10% and 20% more sales daily compared to

the current office. Additionally, we estimate that advertising will pull in an

extra 2% to 10% more sales daily (for the expanded office).

It’s

now time to simulate these two prospects over a large number of cycles or ‘games’

to determine which one pulls in the highest sales in the period under

consideration. Let’s assume that the period of simulation is 6 months and the

current daily sales is $5,000 as previously calculated.

Simulation Results: Produce Store Sales Strategy

A simple computer program

was required to simulate the total period sales for prospects A and B. I created

the program and ran this simulation for 10,000 cycles. Results are shown below:

Prospect A Sales ($, after 6 months)

|

Prospect B Sales ($, after 6 months)

|

1,349,586.82

|

1,096,734.11

|

1,348,620.29

|

1,096,658.02

|

1,348,884.86

|

1,096,665.31

|

1,347,971.19

|

1,096,760.43

|

1,349,250.91

|

1,096,743.23

|

1,348,760.7

|

1,096,785.42

|

1,348,480.92

|

1,096,705.68

|

1,349,177.55

|

1,096,750.2

|

1,348,943.75

|

1,096,730.62

|

1,348,972.28

|

1,096,784.42

|

Prospect

A (opening up a new

office) showed higher sales figures (approx. $1.348 million at the end of the period) than

the option (prospect B) but lower long-term

growth stability. This may mean that even though sales will be much higher

in the short term, they will tend to stabilize or flatten at some point.

Prospect

B (expanding current

office and setting up advertising) showed lower

sales figures (approx. $1.096 million at the end of the period) but higher long-term growth

stability. Observe how the general trend of the sales figures is upwards as

opposed to prospect A with a relatively stable-to-downward sales figure trend.

If the business owner uses prospect B as a strategy,

s/he will experience higher long-term growth amidst lower short-run sales compared

to prospect A.

This is the type of analysis and insight you get by

using game theory to model your business decisions before making them.

I

hope you enjoyed reading this article! If you have a question about simulation

and game theory email me at montyblogger2014@gmail.com

or just reply below with your comments!

No comments:

Post a Comment